Business Insurance in and around Webster

Calling all small business owners of Webster!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected catastrophe or problem. And you also want to care for any staff and customers who stumble and fall on your property.

Calling all small business owners of Webster!

Helping insure small businesses since 1935

Strictly Business With State Farm

With options like a surety or fidelity bond, errors and omissions liability, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent Frank C Argento Jr is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

So, take the responsible next step for your business and visit with State Farm agent Frank C Argento Jr to explore your small business insurance options!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

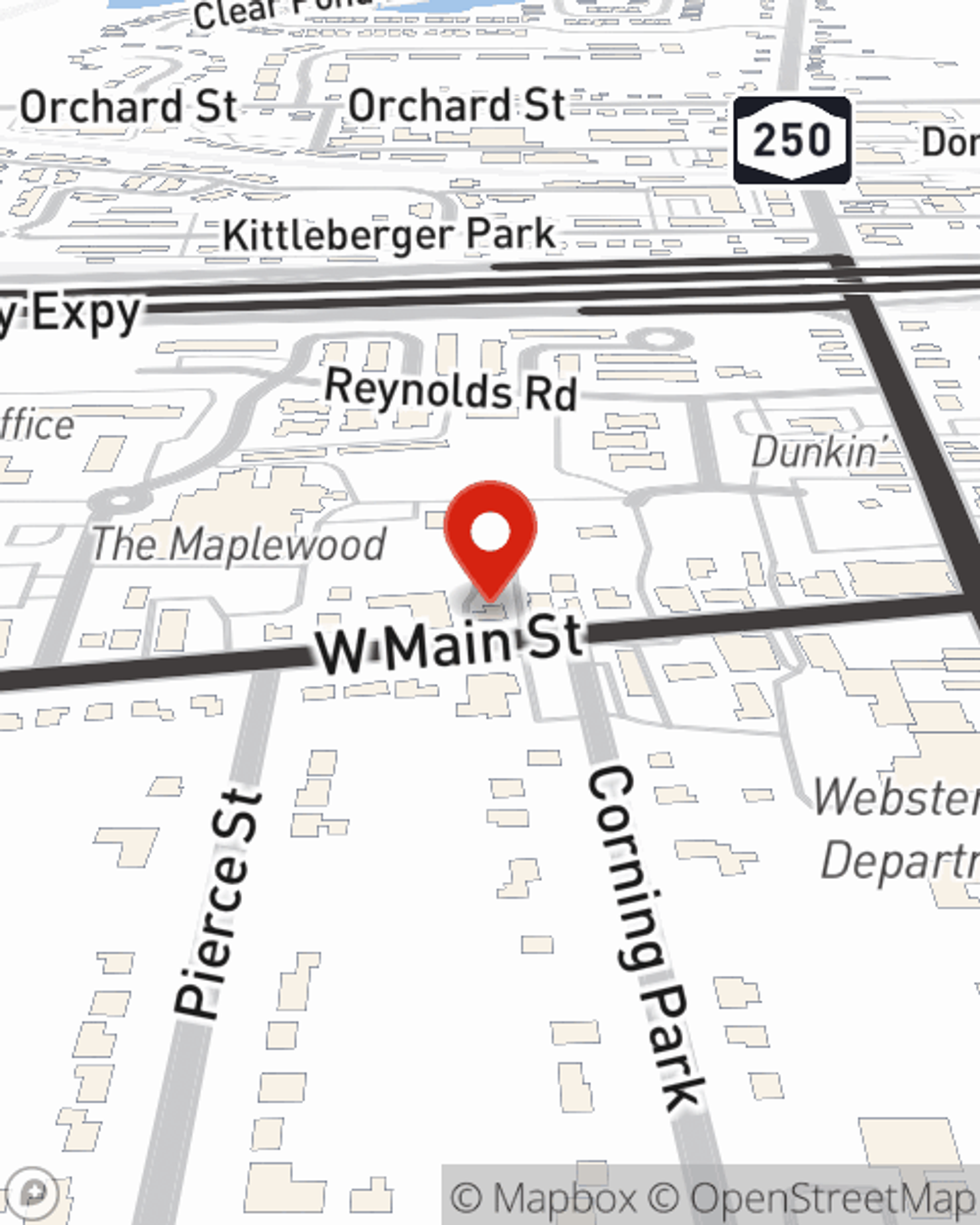

Frank C Argento Jr

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.